Understanding Mean Reversion and Trend Reversal

Understanding Trend is an important task for a trader who are willing to trade to make some profit out of the market. But when does a Trend Reverse or price is just Reverting to the mean? It is a Million Dollar question. So, lets check out how understanding Trend Reversals and Mean Reversion difference can save you from making losses in your trading process.

“Trend is your friend” we have heard this phase from many trading gurus but how to identify the trend and get into it before it gets too late? How we can make some money out of the market by getting into a trend when it dips or when it starts to reverse?

There are a lot of questions going on inside a trader’s mind when it comes to making decision on the basis of trend. It is not quite easy to trade in a trade like it is said. Because, if you are looking forward to go with the trend, you cannot just buy and sell with the macro direction of the market. You need to understand that the price can reverse or revert back to the mean in any given time. So, what to do you may ask?

To get a solid understanding about this critical phenomenon, i have stated some facts about Mean Reversion and Market Reversals below. Just go through the points and try to understand what it is all about and also try to relate the things with the real time market. As in MFX, we are here for a real deal my friend. So, dig in below to learn more about the 2 trend characteristics which maximum traders dont quite understand or follow during his trading process to understand the Trend Structure build up or reversal.

Understanding Mean reversion

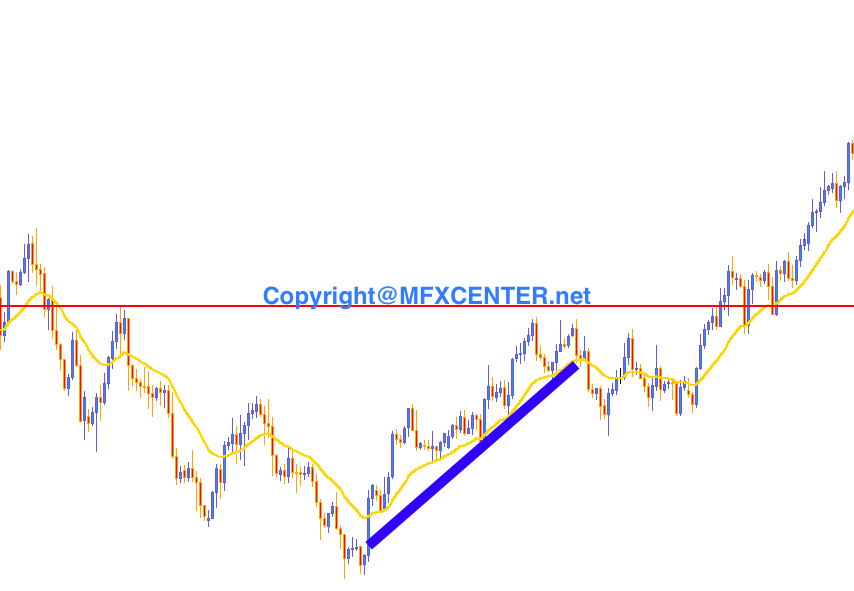

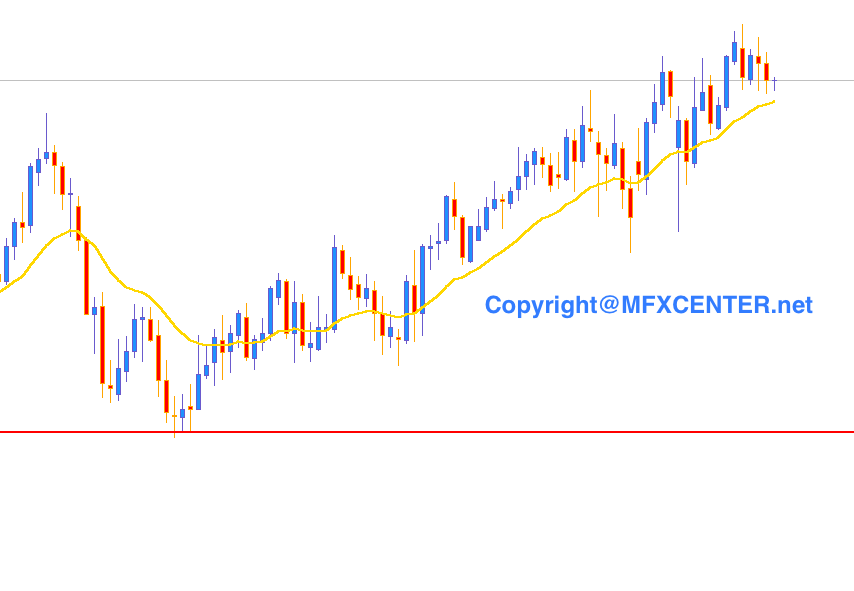

1. Shallow pullbacks – It’s a primary indication that big players are simply pausing, wait for a slightly better price to re-enter the market, and people are still interested at the current price point of the asset.

2. Visually healthy – Believe in your intuition, if a trend is healthy, the pullback should be visually healthy too.

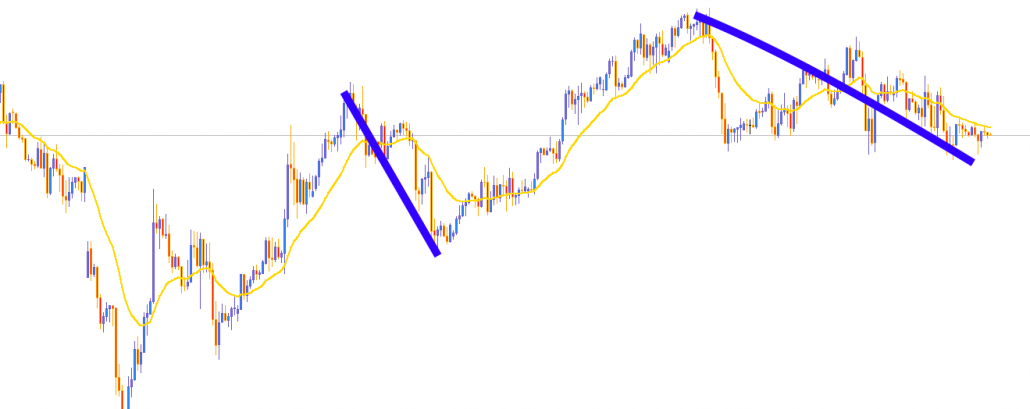

3. Tight range compare to the impulse – Compare the pullback to the impulse, if a pullback digests most of the impulse move, take a step back and re-assess whether its a pullback or reversal. A healthy pullback/ consolidation should be tight and short in duration.

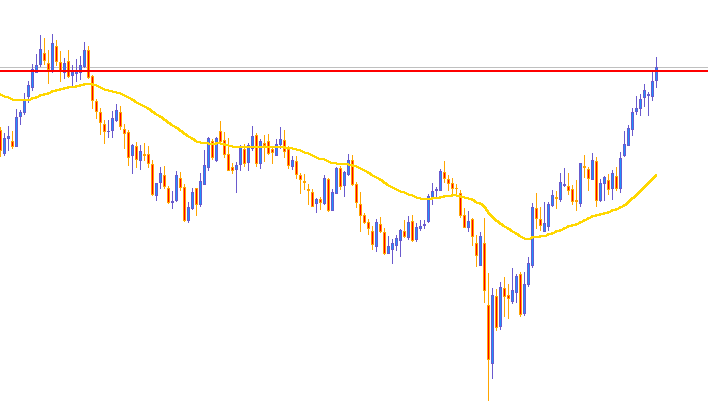

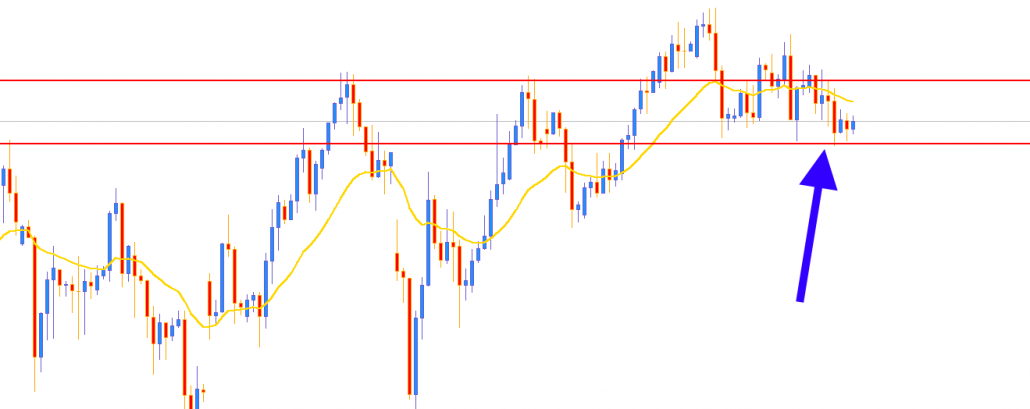

4. Respect key levels – If the trend is bullish , the pullback should not cross below and violates a key technical support. If a key support level is being breached, its a sign that buyers’ that hold the price above that level has lost their interested or temporarily gone.

5. Easily measured – In a healthy uptrend, entries could be measured using trend-following or momentum indicators (Eg. Emas, MACD , VWAP, trendline, etc.)

Understanding Trend Reversal

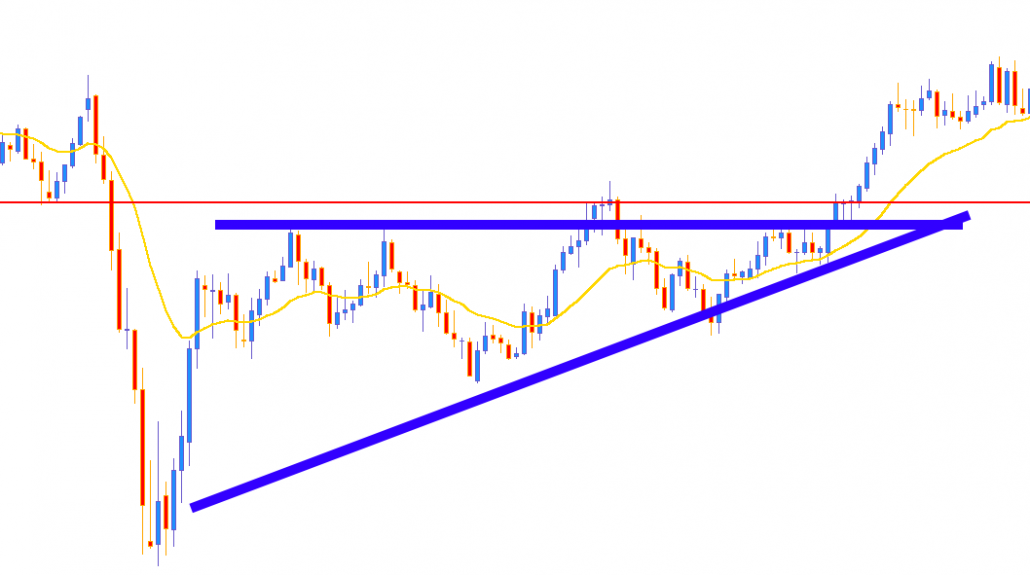

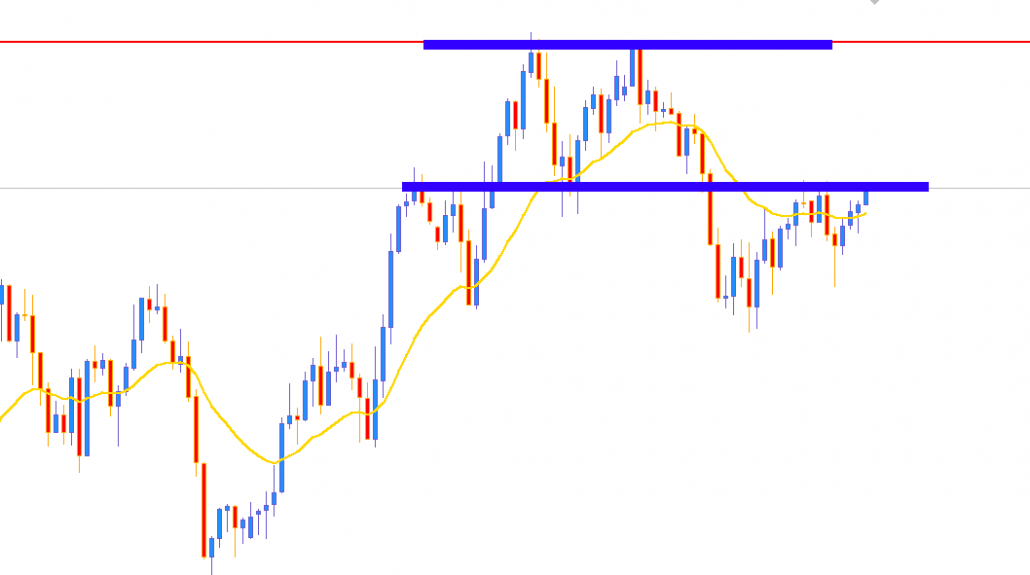

1. Sharp pullbacks – Think about the extreme supply & demand . When a market is over-stretched, it shows that people are blindly chasing it disregard of the current price level. Eg, when everyone is so focused on the buying opportunities during a strong uptrend, people tend to overlook any technical resistance or higher timeframe picture. Market then approach a key technical resistance with bunch of buy orders at high price, big players’ sell orders are being filled at such a great price, all of a sudden the market just snapped and reverse stopping out retail traders, adding up even more selling pressure.

2. Visually unhealthy – When you notice the bullish candles are relatively weak or choppy during an uptrend, and that’s a sign of lack of interest or “out of steam”, the opposite party could temporarily step in.

3. Wide range compare to the impulse – The first sign of reversal is a sharp pullback into the opposite direction, digesting the entire impulse creating shock in the market.

4. Failure to re-visit the high/ low – A bullish trend should consists of simple higher lows & highs sequence. If the trend is bullish but you notice that price keeps failing to re-test the high, that’s a sign of buyers’ weakness.

5. Violate key levels – If the trend is bearish , you should expect key resistance zone to hold. If there’s a sudden momentum shift breaching key resistance level , its a sign that buyers has overcome the sellers.

Conclusion

Understanding Trend Reversals and Reversions are pretty important task but it would not make you a better trader overnight. You need to practice and make the techniques discussed above subsconscious. You need to make it automatic. Like when you see it, it takes only 2 seconds to recall everything you read above and identify where the market is heading. A small Disclaimer, sometimes it will not work cause nothing work 100% but it is the best way to understand a trend and understand when it can reverse. So, take calculated risks and make sure to trade safe and trade better everyday.

One of the best thing to eliminate the little chances of making mistakes understanding the trend is Understanding Market Context. If you want to learn more about Market Context and Price Action Weapons along with a lot of trading analysis materials, feel free to join MFX University today.

courtesy – trading view writer (unknown)