Complete Guide to Trading Synthetic Indices and VIX

Synthetic Indices and VIX are gaining popularity quite rapidly in the world. Indices like Crash and Boom and VIX is now attracting investors all over the planet, but there are lack of reliable and complete guide to trading Synthetic Indices and VIX. So, if you are trying to trade VIX and other Synthetic indices like Crash and Boom, here is the Complete Guide to Trading Synthetic Indices and VIX.

What are Synthetic Indices?

Synthetic indices are generally simulated trading instruments which move on the basis of an underlying asset usually based on the stock market and other financial markets. Synthetic index generally depends on randomly generated numbers and sometimes stock market volatility.

One of the best thing about Synthetic indices is that brokers cannot manipulate the market as the random numbers generated in this market is programmed by a cryptographically secure computer program and for transparency issues. It is quite similar to any other financial market but in this case, the broker cannot have a single influence on the market movement. Moreover, the volatility indices charts are audited by a third party for ensuring fairness of NO MANIPULATION based trading environment.

Why You Should Trade Synthetic Indices over Forex?

A most asked question is, traders have a lot of instruments to trade in Forex and recently Crypto currency also jumped in, so why a trader should trade Synthetic Indices over Forex and Crypto. Lets find out from the points below

- Underlying Asset / Cause of Movement – Forex is based on the movement and Relative Strength of the real currencies of the countries but Synthetic indices are random computer generated numbers which cannot be manipulated with any fundamentals or political aspects

- Volatility – Volatility in Forex trading is quite variable and sometimes you might get stuck due to global recession or pandemic issues like Coronavirus or political unrest in the countries. On the other hand, Synthetic indices have got constant volatility throughout the year. There is no best time to trade synthetic indices as their rate of movement is same 24/7/365.

- Availability – Forex market is open 24/5 whereas Synthetic Indices market is open 24/7. As we mentioned above, it contributes well to the volatility and does not constrain you to trade in a specific or segmented manner.

- Market Movement Does not Depend on Fundamentals – Forex market’s main drivers are fundamentals which pushed the market to hit a definite trend but as Synthetic indices are not impacted by fundamentals, so, there is no sudden risk of news rollout or fundamental issue based volatility.

What are the Different Types of Synthetic Indices?

There are currently 4 types of Synthetic Indices available for trading –

- Volatility indices

- Crash and Boom indices

- The Step index

- Range Break index

Additionally, Synthetic Indices can be also divided into 2 broad category –

- Continous Indices – these indices move non-stop 24 hours a day, 7 days a week and 365 days a year. Non-stop.

- Daily Reset Indices – these indices replicates the markets with constant volatility but resets at GMT time 0:00 hours. There are two Daily Reset Indices – The Bulls Market and The Bears Market.

What are the Volatility Indices?

image source – avatrade.com

Volatility Indices are a type of synthetic indices which are simulated markets that mimic the real world market volatility. There are currently 5 volatility indexes –

- Volatility 10 index (V10 index)

- Volatility 25 index (V25 index)

- Volatility 50 index (V50 index)

- Volatility 75 index (V75 index)

- Volatility 100 index (V100 index)

The numbers on the indices represent the volatility of the index relative to the real financial market volatility. As market volatility is measured from the scale of 0 to 100, so the maximum number of VIX is 100.

So, V10 index represents 10% of the market volatility whereas V100 index represents 100% of the market volatility. Usually VIX updates on every 2 second per tick. So, it is a bit slower to measure the volatility for which there is also 1 second per tick based VIX indices to trade. Those VIX indices are represented as –

- Volatility 10 Index (1s)

- Volatility 25 Index (1s)

- Volatility 50 Index (1s)

- Volatility 75 Index (1s)

- Volatility 100 Index (1s)

Additionally, there are High Frequency-based Volatility Indices which are only available on the MetaTrader 5 platform and they move four times faster than the corresponding normal volatility index. They are –

- (HF) Volatility Index 10

- (HF) Volatility Index 50

- (HF) Volatility Index 100

The main difference between Normal index and HF index is that HF index is 4 times faster than the Normal index. As an example, HF Volatility Index 10 moves 4 ticks faster than normal Volatility 10 index and the HF Volatility 100 index moves 4 ticks faster than Volatility 100 Index. HF indices update at the rate of two ticks every second and are thus 2 times faster than the (1s) indices.

To learn how to trade ANY MARKETS like FOREX, STOCKS, COMMODITIES, CRYPTO and even SYNTHETIC INDEX, JOIN MFX UNIVERSITY TODAY at DISCOUNTED PRICE.

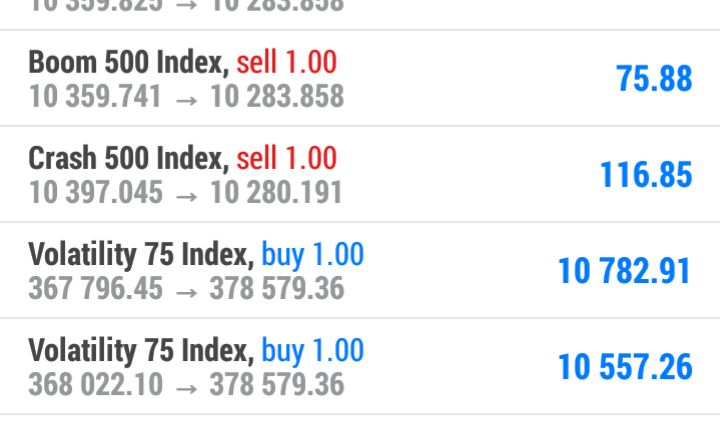

What is Boom and Crash Indices?

Boom and Crash are synthetic indices directly related to Forex trading. These are the markets that ticks base on the simulation from stocks, oftentimes there are single future assets like Boom 500 or Crash 500 which might be simulated by over 100 company’s stocks. As simulations are done based on complex computer-generated calculations, it is hard for even brokers to manipulate the prices.

There are mainly 4 types of Boom and Crash indices

- Boom 500

- Boom 1000

- Crash 500

- Crash 1000

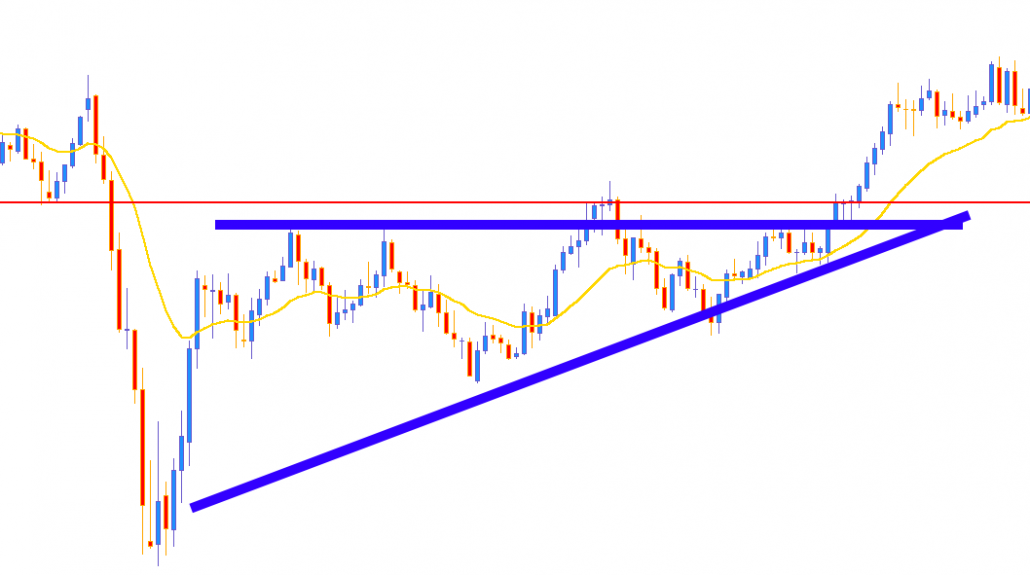

The numbers after the indices name indicate the average number of ticks, so the calculation here is a bit tricky in some cases. With Boom 1000/500 index, there’s an average of one spike in the price series that occurs at any time within 1000/500 ticks. Often times it’s hard to study how to trick the market, but if you can understand the market context and study the market behaviour, then you can make a good profit out of it. To learn about Market Context in-depth analysis – you can Join MFX University today.

Sometimes, traders try to find the correlation between Crash and Boom indices which is quite not right. Additionally, sometimes traders try to think that, Crash is made to go down and Boom is made to go up. That is also not right either. So, you need to think of these indices are separate entity rather than just looking for some negative and positive correlations. If you can understand the market context and get into deeper technical analysis section, trading any indices would be great.

To learn how to trade ANY MARKETS like FOREX, STOCKS, COMMODITIES, CRYPTO and even SYNTHETIC INDEX, JOIN MFX UNIVERSITY TODAY at DISCOUNTED PRICE.

What are the Advantages of Trading on Synthetic Indices?

image source: stock investor

Forex, Stocks, Futures, Commodities and Cryptos are the rocking star in trading industry. People are willing to trade these instruments and have a healthy portfolio. So, what makes Synthetic indices attractive despite having a wide variety of trading instruments out there? Why you should think of starting to trade synthetic indices and how it can help you over other instruments to be more profitable. Lets check out the points below –

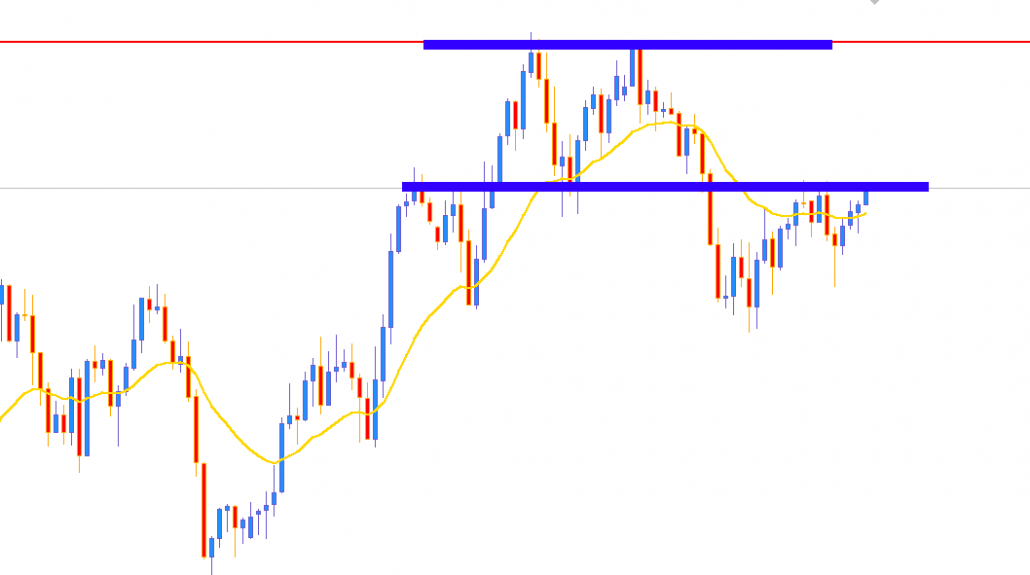

- Synthetic Indices are not impacted by any kind of Fundamentals – As these indices represents the behavior of the financial markets but since they are like any other financial instruments, they are not impacted by the fundamentals like interest rates, employment reports, dividend announcement etc.

- Synthetic Indices have Uniform Volatility – In these indices there is no separate timezones to concentrate or any time of the week or any news announcement to look into. So, as a result, the indices volatility does not quite get dull or hiked up due to any external factors rather than just market sentiments which remains quite uniform in most of the times.

- Tradeable 24 hours a day, 7 days a week – This is somehow good in a sense but also bad in macro perspective. Good in a sense that traders can trade anytime, anywhere and dont have to bother about weekend gaps or any close of the market. Bad in a sense that traders may get addicted to it and may have certain impact on their personal life. If they can manage things well, balance life and work, i think it is great to have a non-stop market even in the weekends.

- Low Spreads and High Leverage – One of the biggest challenge for most of the markets is not a challenge for Synthetic indices. You will have lowest spread possible and highest leverage possible to trade any indices in the synthetic instrument list.

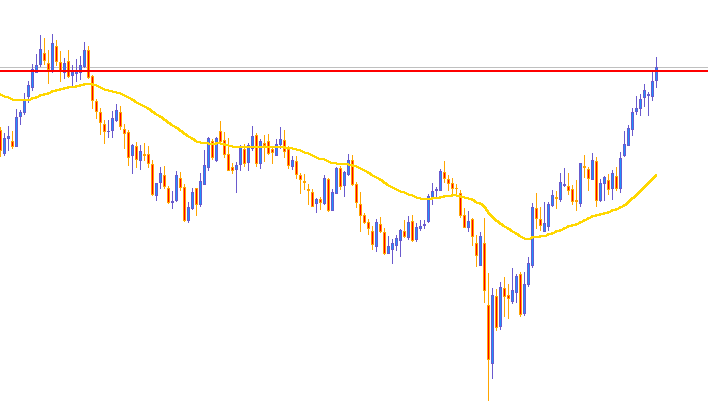

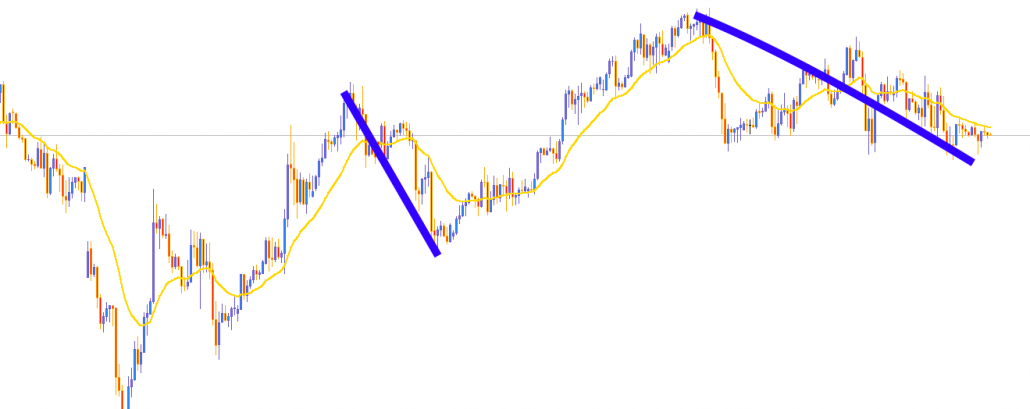

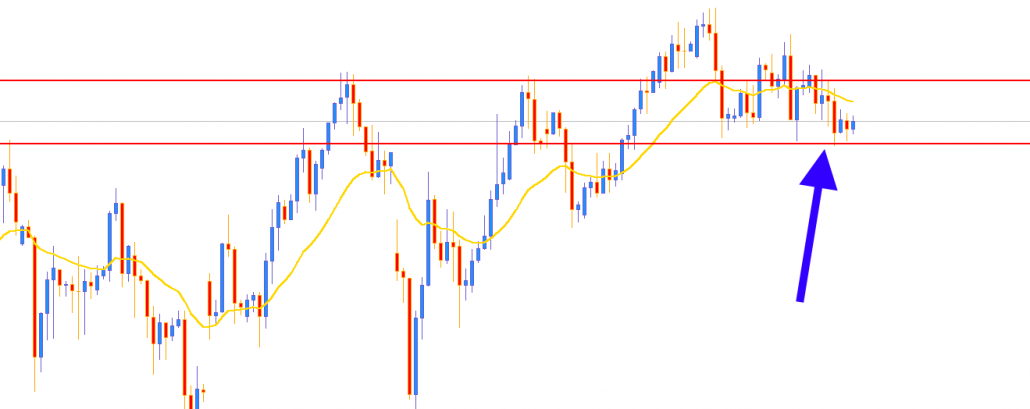

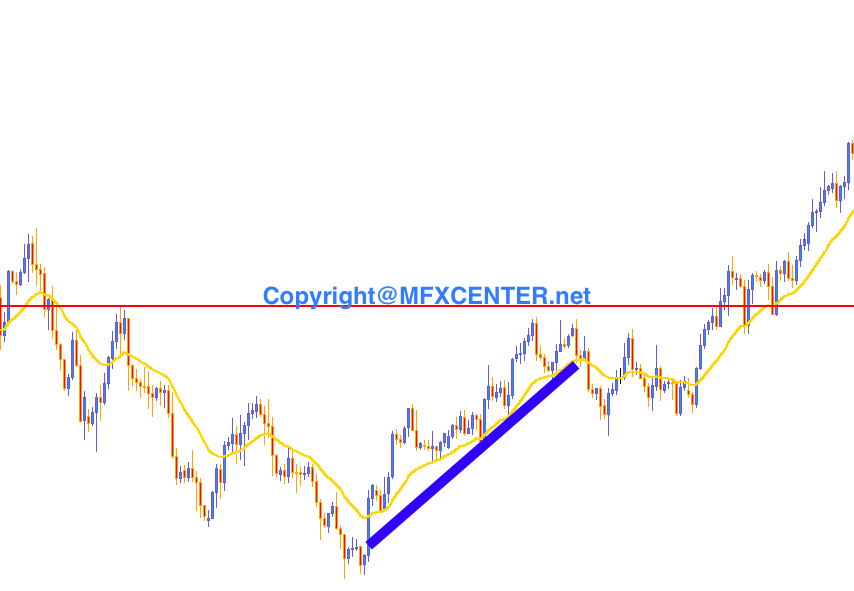

- Simple Price Action Strategies can make you Money – Just trading with support and resistance and identifying market context at a novice level can help you make some money in this market. If you can understand some price patterns and how they work, you are all set to make some money even with lowest deposit like $50.

- Demo trading available – Just like Forex markets, Synthetic indices can be tested with a demo account. You can trade in Meta Trader 5 and open a demo account to learn about the market before investing your real hard earned money.To learn how to trade ANY MARKETS like FOREX, STOCKS, COMMODITIES, CRYPTO and even SYNTHETIC INDEX, JOIN MFX UNIVERSITY TODAY at DISCOUNTED PRICE.

Disadvantage of Trading on Synthetic Indices

image source: dutch cannabis seeds

Just like great advantages we just discussed, there are certain disadvantages as well which if not considered, then you might end up losing a lot of money in this market.

- You Cannot Trade with 0.01 lot in all Synthetic Indices – in Forex or Stocks or Futures, you can trade with minimum lot size of 0.01 but in indices you cannot have that uniformed lot size. There are certain restrictions for the lot size in some indices. Lets take a deeper look into them and make sure to make the minimum lot sizes SUBSCONSCIOUS in your mind before even trying to trade one in real account. ** To be noted – some brokers may accept 0.01 in all VIX and Synthetic indices in the near future but currently there is certain restrictions on the lot size as we have mentioned below.

- Volatility 10 index – Minimum lot size 0.30

- Volatility 25 index – Minimum lot size 0.50

- Volatility 50 index – Minimum lot size 3.00

- Volatility 75 index – Minimum lot size 0.001

- Volatility 100 index – Minimum lot size 0.20

- Volatility 10 (1s) index – Minimum lot size 0.50

- Volatility 25 (1s) index – Minimum lot size 0.50

- Volatility 50 (1s) index – Minimum lot size 0.005

- Volatility 75 (1s) index – Minimum lot size 0.005

- Volatility 100 (1s) index – Minimum lot size 0.10

- Boom 1000 Index – Minimum lot size 0.20

- Crash 1000 index – Minimum lot size 0.20

- Boom 500 index – Minimum lot size 0.20

- Crash 500 index – Minimum lot size 0.20

Traders needs to be extra cautious when trying to ensure that you are trading with proper risk calculated manner and you understand that you have a big position despite trading with the minimum lot size of that instrument. If you dont give attention to it, your whole account can be wiped out in matter of minutes.

2. There are very few Volatility Indices to choose – As of current writing date, there are around 17 trading instruments which includes Step Index and Range Break index as well.

3. Volatility indices are very Volatile – As the name suggests, if you are familiar with volatility commodity like Gold and currency pair like GBPJPY, i think you understand what high volatility means. The indices can react very fast in short periods of time and make you a fortune and also wipe your whole account. So, good trade management and proper trade planning is required before entering a trade in this market.

4. Some indices have large SL levels – You might be astonished to see how many points a stop loss level of an indices can have. For example – Volatility 50 index has a stop loss level of 40,000 points or about $US 12 using the smallest lot size of $3. So, if you are trading with $50, a single trade can cost you 20% of your account if you hit the stop loss.

5. Server Maintenance can wipe out historical data – As there are some quotes in trading like “History repeats”. “Historical levels holds” etc. Sometimes as the servers goes under maintenance, you might see blank history in some cases as the server removes the historical calculations and computer generated prices.

6. Risk of Overtrading – As the market remains open for 24/7/365, you might find yourself overtrading and trading in your personal time. If you have family and friends, you might forget them as well, as you get into this money making mayhem.

To learn how to trade ANY MARKETS like FOREX, STOCKS, COMMODITIES, CRYPTO and even SYNTHETIC INDEX, JOIN MFX UNIVERSITY TODAY at DISCOUNTED PRICE.

Where to Start Trading the Synthetic Indices?

image source: techstory

So, if you think that, Advantages over the Disadvantages of Synthetic Indices attracts you to trade then You can start trading Synthetic Indices in only 5 minutes.

Just click on ONE OF THE BROKER NAME Button Below to open your account, You can Open Accounts on both broker and try which broker suits your trading conditions and strategy. **Please note – MFX Center does not own any responsibility and any liability of your funds in the brokers. MFX Center and MFX authorities will not be held responsible for damage of funds or broker liquidation or any other fraudalent activity of the broker in any future periods.

As it is a new form of trading, so you can test yourself in Demo account before getting into the markets with real money. MFX suggest you to trading in Demo account atleast for few weeks, before getting into with the real money in trading whether Forex or Derivatives.

If you want to know how to open an account, please watch the videos below..

To check more articles on different trading subject, please visit THIS LINK.

To learn how to trade ANY MARKETS like FOREX, STOCKS, COMMODITIES, CRYPTO and even SYNTHETIC INDEX, JOIN MFX UNIVERSITY TODAY at DISCOUNTED PRICE.

For any query or chat – CLICK HERE